Inventory of funds and settlements. Inventory of funds held in bank accounts and other accounts Account inventory 51 sample filling

The provisions of Russian legislation establish the obligation of domestic companies to verify the compliance of the actual existence of values, obligations, other property or non-property rights with the accounting information of the organization. This requirement applies exclusively to legal entities and is equally true for the inventory of funds in the company’s current account, as well as in the case of reconciliation of other indicators of the subject of economic relations.

Inventory

The Ministry of Finance of the Russian Federation issued Order No. 49 on June 13, 1995. This document put into effect Guidelines for the procedure for conducting an inventory of property and liabilities of legal entities. Currently, this rule of law is decisive when conducting checks to determine whether the actual state corresponds to the accounting information of the enterprise.

As follows from the named act of rulemaking, inventory can be:

- mandatory, that is, carried out upon the occurrence of cases listed by the Ministry of Finance of Russia in its Guidelines;

- proactive, carried out solely at the will of the enterprise.

Any inventory, regardless of the reasons for its conduct, begins with the issuance by management of a written order for inspection.

The inventory commission has the authority to conduct reconciliation and document its results. It is legitimate only in its entirety, specified in the relevant order for the enterprise.

This requirement equally applies to the reconciliation of the organization’s assets and liabilities, as well as to the inventory of funds and settlements of the enterprise.

The results of the inspection are subject to reflection in acts and inventories drawn up and signed upon completion of the inventory. To correctly format the reconciliation results, it is recommended to use the forms put into effect by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88. It is important to note that currently the forms of such documents are not mandatory for use and each organization has the right to develop its own forms.

Inventory of funds and settlements

The Ministry of Finance of the Russian Federation, in paragraph 3.43 of its Guidelines, approved by Order No. 49 of June 13, 1995, provided for some features of reconciliation of money in enterprise accounts with credit institutions. The organization, by checking the consistency of accounting data and information contained in bank statements, makes an inventory of funds in the current account.

The Russian Ministry of Finance described the procedure for reconciling settlements with banks, suppliers, buyers and other counterparties somewhat differently. In accordance with paragraph 3.44 of the Methodological Instructions, such reconciliation is carried out by checking the validity of certain amounts listed in the accounting accounts of the enterprise.

The financial department also noted the following features of checking certain types of calculations:

- relationships with suppliers for paid and undelivered or uninvoiced goods are reconciled using account 60 against the relevant documents, taking into account corresponding accounts;

- debt in favor of employees in the form of the amount of unpaid wages is subject to verification;

- relationships with reporting employees must be verified;

- According to the documents, an inventory of settlements with counterparties, relationships regarding shortages, amounts of accounts payable, receivable and depositors should be carried out.

The results of the inventory of funds in the current account are formalized by filling out form No. INV-17, approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88. The same document should be used when summarizing the reconciliation of funds and settlements.

Inventory is carried out without fail when preparing annual reports. Organizations carry out settlements with counterparties, the budget, extra-budgetary funds, both in cash and using non-cash payments. With this form of payment, transactions are carried out by banks from the bank accounts of the organization. An organization has the right to open settlement, currency and other (special) accounts in a bank, which are intended for settlements in Russian and foreign currencies.

The current account is intended for the storage and movement of funds in the currency of the Russian Federation. An organization may have one or more current accounts with different credit institutions. A foreign currency account stores funds in foreign currencies. The organization has the right to have foreign currency accounts within the country and abroad.

Special accounts in banks are opened in order to reflect the availability and movement of funds in the currency of the Russian Federation and foreign currencies, in letters of credit, check books, other payment documents (except bills), in current, special and other special accounts, as well as funds for targeted financing in that part of them that is subject to separate storage.

Before starting the inventory, it is established: what accounts and in which credit institutions the organization has. For this purpose, all existing banking service agreements are studied. In this case, it is necessary to confirm the legality and feasibility of opening an account and using one or another form of payment. The use of payment forms depends on the location of the supplier and buyer. In this regard, non-cash payments are divided into non-resident and same-city (local).

During the inventory process, it is necessary to compare the terms of the agreement for opening a bank account with synthetic accounting data confirming the cash balances in the organization’s accounts. To summarize information about the availability and flow of funds, account 51 “Current accounts” is intended. In this account, funds are valued only in the currency of the Russian Federation (rubles).

The movement of cash in foreign currencies is carried out on account 52 “Currency accounts”. Organizations open two subaccounts to this account. During the inventory, it is established that the organization has currency accounts within the country (subaccount 1 “Currency accounts within the country”) and for Rubens (subaccount 2 “Currency accounts abroad”). When taking inventory of funds in a foreign currency account, the correctness of converting the balance in foreign currency into rubles is checked based on the official ruble exchange rate established by the Bank of Russia. The procedure for converting currency values into rubles is determined by the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2000), approved by Order of the Ministry of Finance of Russia dated January 10, 2000 No. 2n.

For reflection in accounting and reporting, the following is recalculated into rubles: the value of assets and liabilities expressed in foreign currency (banknotes at the organization’s cash desk, funds in bank accounts, cash and payment documents, financial investments, settlement funds, fixed assets, intangible assets , inventories and other assets and liabilities) (clause 4 of PBU 3 / 2000.). The procedure for converting the value of assets and liabilities into rubles is different. For banknotes at the cash desk, funds in bank accounts, cash and payment documents, short-term securities, funds in settlements, balances of target financing funds, their value is recalculated into rubles twice: on the date of the transaction in foreign currency, and also on the reporting date preparation of financial statements (clause 7 of PBU 3/2000). Moreover, for reporting purposes, the value of these assets and liabilities is recalculated into rubles at the rate of the Central Bank of the Russian Federation in effect on the reporting date (clause 8 of PBU 3/2000). Exchange differences arising as a result of recalculation are subject to credit to the financial results of the organization as non-operating income or non-operating expenses (clause 13 of PBU 3/2000). Negative exchange rate differences are reflected in accounting as they are accepted by entry: Debit 91/2 “Other expenses”, Credit accounts 50, 51, 52, etc.

Positive exchange rate differences are reflected by a reverse entry to the credit of account 91/1 “Other income”. Accounting for cash flows when using other forms of payment is kept on account 55 “Special accounts in banks”. During the inventory, it is established whether the organization has such accounts and the remaining amounts on them. Three subaccounts can be opened for account 55 “Special accounts in banks”: 55/1 “Letters of Credit”, 55/2 “Checkbooks”, 55/3 “Deposit Accounts”. If there are other current and special accounts, additional subaccounts are opened to this account. Funds held in special bank accounts are valued both in rubles and in foreign currency. Moreover, the accounting of funds in these accounts is carried out separately.

The transfer of funds to these accounts is reflected in the accounting records: Debit 55 “Special accounts in banks”, Credit 51 “Settlement accounts”, 52 “Currency accounts”, 66 “Settlements for short-term loans and borrowings”.

The use of account funds according to bank statements is accompanied by the posting: Debit 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”; Credit 55 “Special bank accounts.”

Unused funds are returned to the bank accounts from which they were transferred, which is documented by posting: Debit 51, 52, Credit 55.

An inventory of funds held in banks is carried out by reconciling the balances of the debit amounts of accounts listed on the corresponding accounts according to the organization’s accounting department with the data of bank statements (closing balance according to bank statements). The organization must obtain confirmation from the bank of the amounts in its accounts. At the same time, a reconciliation of the correspondence of balance amounts in analytical and synthetic accounting with account balances in the balance sheet is carried out (form No. 1 - lines 262, 263, 264). During the inventory, the identity of the turnover in the debit and credit of the accounts is checked with the data contained in the bank statements.

The inventory commission must check the bank statements with the attached supporting documents, which establishes the correctness of the amounts indicated in the statement.

The completeness of bank statements is determined by their page numbering and the transfer of the account balance. The closing balance on the previous bank statement must equal the opening balance on the next statement.

The inventory commission determines the reliability of the extracts by checking all their details. If there are corrections, it is necessary to carry out a counter-reconciliation of these statements with the entries in the first copy of the personal account located at the bank.

During the inventory process, you should ensure the reliability and authenticity of all monetary settlement documents. In case of doubt, a counter-reconciliation of monetary settlement documents attached to the bank statement stored by the organization is carried out with documents held by the bank or the counterparty to the transaction. Simultaneously with checking the reliability of transactions and the authenticity of bank documents, the correctness of the correspondence of accounts and entries in synthetic accounting registers is revealed. Amounts identified as a result of the inventory, erroneously credited or debited to current, currency or other accounts and discovered when checking bank statements from these accounts, are reflected in the accounting records as follows: Debit 76 / 2 “Calculations for claims”, Credit 51, 52 , 55.

For the amounts of received payments, a posting is made in accounting: Debit 51, 52, 55, Credit 76 / 2 “Calculations for claims.”

To document the results of an inventory of settlements with credit institutions for claims made for amounts erroneously written off (transferred) to the organization’s accounts, an act of inventory of settlements with customers, suppliers and other debtors and creditors is used (form No. INV-17), to which a certificate is attached, reflecting information about the balances of amounts listed in subaccount 76 / 2 “Calculations for claims”.

Accounting for funds in transit is kept in account 57 “Transfers in transit.” An inventory of funds in this account is carried out by checking the documentary substantiation of the amounts reflected in it. For each document, the inventory commission determines the timeliness of crediting the transfer to the bank account. If necessary, written requests can be made to the bank or post office about the reason for the delay in crediting or transfer. The results of the inventory of funds in transit are given in the act (inventory) reflecting the amounts by direction of transfers listed as “transfers in transit.” For each amount, the number and date of the document is indicated (receipts from banks, post offices, copies of accompanying statements for the delivery of proceeds to collectors, etc.). The results of the inventory act are verified with the analytical accounting data in account 57 and the amount reflected in line 264 of the second asset section of the balance sheet.

Accounting for funds in account 57 “Transfers in transit” is carried out in rubles and foreign currency. For the amounts of funds deposited from the cash desk to the bank, reflected as funds in transit (transfers), the following entry is made in accounting: Debit 57, Credit 50.

When crediting funds that were in transit to a current or foreign currency account, the following entry is made in accounting: Debit 51, 52, Credit 57.

Cash balances in cash, on settlement, foreign currency and special accounts in banks are reflected in the second section of the balance sheet under the group of items “Cash”.

How to make an order to conduct an inventory using the INV-22 form in 1C 8.3

There is no special document for inventorying funds on a current account in 1C 8.3 Accounting 3.0. But, in order to print the order for inventory taking form INV-22 from the 1C 8.3 program, we will use the printed form of other documents. For example, Inventory of goods. For this:

- Create a new document Inventory of goods. Chapter Warehouse – Inventory – Inventory of goods:

Button Create:

- Fill out the Inventory bookmark.

Here you should indicate the period for conducting the inventory, details of the order, and the reason for the inventory:

- Fill out the Inventory Commission tab.

The table lists the members of the commission and checks the name of the chairman:

- We create and edit the printed form of the order INV-22.

Button Seal- order according to f. INV-22:

On the screen: Preview mode unified form INV-22 Order to conduct an inventory:

We turn on the printing form editing mode and fill in the empty required lines, for example, “Inventory is subject to...”, etc. The document in 1C 8.3 can be printed (button Seal) or save as a file (button Save to disk).

How to edit documents for printing manually in 1C 8.2 (8.3), see our video tutorial:

How to take inventory of funds in a current account in 1C 8.3

Inventory is carried out through a comparison of cash balances in accounts (settlement or foreign exchange) registered in accounting with information. Account turnover for each day must be reconciled so that the amounts at the beginning of the day coincide with the balance received at the end of the previous day.

Bank statement (or personal account statement) is a document containing information about the current state of the organization’s accounts. In 1C Accounting 8.3, documents are used to conduct cash transactions. You can view balances at the beginning of the day, turnover during the day and balances at the end of the day from the Bank Statements list. Chapter :

We indicate the bank account, organization, select any document for the date of interest - now you can view the necessary data: cash balances and account turnover for the selected day:

Also for analysis in 1C 8.3 there is a convenient opportunity to use standard reports. For example, the report Account turnover for account 51. Section Reports – Standard reports – Account turnover:

Let's configure the report (button Show settings):

- In the header of the report, set the period, indicate the account - 51, select the organization.

- On the Grouping tab, specify the frequency of report generation - By days and the method of grouping - Bank accounts:

- On the Selection tab, select the desired bank account:

- On the Indicators tab, specify the data to be displayed in the report:

Press the button Form. On the screen: report Account turnover 51:

The data displayed in the report in 1C 8.3 allows you to check the balances and turnover of funds in the current account for each day of the selected period.

It is very difficult to imagine that with automated accounting, both shortages and, less often, surpluses may appear in the current account, but such situations are possible. Let's look at what needs to be done in 1C 8.3 Accounting in these situations.

If there is a surplus in the current account

Suppose that as a result of the analysis at the end of the day on March 31, 2016, it was discovered that the balance according to the accounting data is less than the balance according to the bank statement by 1,000.00 rubles. The balance according to the bank statement is 1,713,118.45 rubles, the balance according to accounting data is 1,712,118.45 rubles).

Surpluses are reflected in accounting. accounting (BU) by posting Dt 51 - Kt 91.01, in tax accounting (NU) - this is Other non-operating income and expenses. In 1C 8.3, this operation is carried out using the document Receipt to a bank account:

- Enter the document Receipt to the account." Chapter Bank and Cashier – Bank – Bank statements- button Admission.

- Fill in the fields of the document:

- Loan account – 91.01;

- Other income and expenses – Other non-operating income (expenses) accepted for tax accounting (the “Accepted for tax accounting” flag is set in the directory element):

- We post the document (Post button) and check the movements made by the document:

- Let's build a report Account turnover for 51 accounts and make sure that as of 04/01/2016. The account balance corresponds to the balance indicated in the bank statement:

You can check transactions on account 91.01 using the Account balance sheet report. We will create the report as of the date of adjustment – 04/01/2016. The report shows that the discrepancy amount is RUB 1,000.00. reflected in BU and NU:

If “deficiencies” are detected in the current account

A shortage of funds can be identified both during inventory and during the daily routine work of an accountant. There are situations when the bank unintentionally debits any amounts from the current account. Having discovered such “deficiencies”, you should first of all submit a written application to the bank so that the bank credits the written-off amounts to the organization’s account.

According to Art. 856 of the Civil Code of the Russian Federation, if the bank unreasonably debits funds from the client’s account, the bank must pay interest. The procedure for calculating interest is stipulated in Art. 359 of the Civil Code of the Russian Federation.

Let’s say that when checking bank statements, an accountant discovered a write-off of RUB 10,000.00. in favor of an unknown counterparty.

In 1C 8.3, this situation will be formalized by the document Write-off from a personal account, posting Dt 76.02 - Kt 51.

- We create the document Write-off from a personal account. Chapter Bank and Cashier – Bank – Bank statements- button Write-off.

- Fill in the fields of the document:

- Document transaction type – Other write-off;

- Recipient – can be left blank;

- Amount – identified discrepancy;

- Debit account – 76.02 “Calculations for claims”:

- We post the document (button Conduct

The accountant transmits information about the shortage in writing to the bank. After a few days, the bank returns the written-off funds to the bank account and pays interest in the amount of 52.00 rubles.

The transfer of funds will be carried out using the document Receipt to a cash account, posting Dt 51 – Kt 76.02.

1. Create a document Receipt to a bank account. Chapter Bank and Cashier – Bank – Bank statements- button Admission.

- Fill in the fields of the document:

- Document operation (type) – Other receipt;

- Payer – may not be filled in;

- Amount – identified discrepancy;

- Loan account – 76.02 “Settlements of claims”:

- We post the document (button Conduct) and check the movement of the document:

Similarly, we will credit the account with the interest transferred by the bank for erroneous debiting of funds (entry Dt 51 - Kt 76.02).

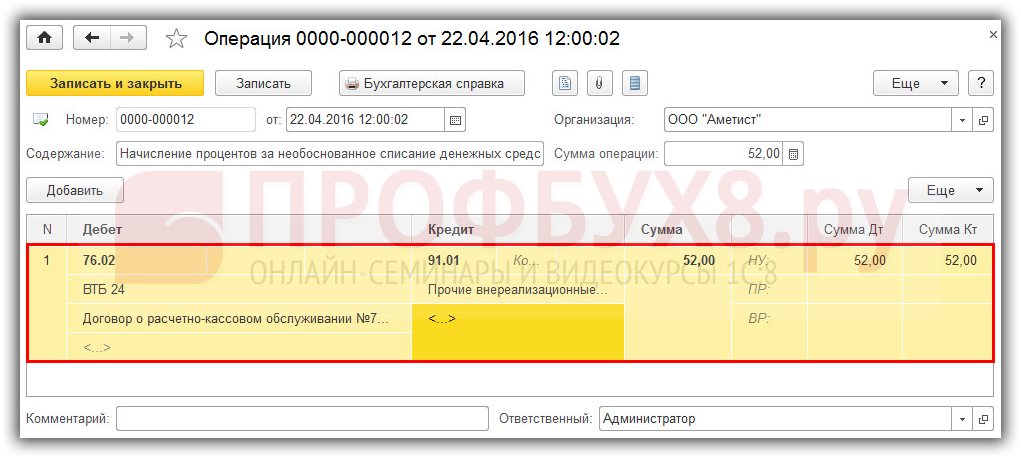

We will calculate interest for the bank’s erroneous debiting of funds from a personal account in 1C 8.3 using the Operation document. Chapter Transactions – Accounting – Manual Transactions- button Create:

Posting for interest accrual: Dt 76.02 – Kt 91.01. In tax accounting, interest received is recognized as other income:

Let's build a SALT report for account 76.02 to check the correctness of document posting in 1C 8.3:

Inventory of cash at the cash desk in 1C 8.3

The document Methodological Instructions for Inventorying Property and Financial Liabilities (Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49) describes the procedure for conducting an inventory of the cash register.

Cash inventory report form INV-15

To reflect the results of the cash register inventory, you need to generate a cash inventory report, form INV-15:

- The act must provide information about cash, securities, as well as monetary documents (stamps, air tickets, coupons, etc.);

- This information was obtained by the inventory commission as a result of the recalculation of funds;

- The act records the amount of cash that should be in the cash register based on the cash book entries, the latest numbers of PKO and RKO, and also reflects surpluses or shortages.

Unfortunately, in 1C 8.3 Accounting there is no standard mechanism for creating and printing INV-15 Cash Inventory Report. The developers have registered this user request and perhaps it will be realized over time. There are currently two options to resolve the situation:

- or fill out the act according to f. INV-15 manually;

- or order programmers to write processing intended for filling out and printing the act according to f. INV-15.

So, approximately, the cash inventory act, form INV-15, may look like in the 1C 8.3 program:

1C Accounting 8.3 does not provide a special document to reflect the inventory of funds in the cash register. Earlier in this article, it was discussed how to issue an order using f. in 1C 8.3. INV-22.

If there is a shortage of funds at the cash register

If, as a result of the inventory of funds, there is a shortage in the cash register, that is, the actual balance of funds in the cash register is less than the balance reflected in the accounting, then it is attributed to the MOL, that is, to the cashier of the organization.

Let's say on 04/01/2016. There is a shortage in the cash register in the amount of 158.12 rubles. In 1C 8.3, such a situation will be formalized by the Cash Issue document, posting Dt 94 - Kt 50.01.

- Enter the Cash Out document. Chapter - button Issue.

- Fill in the fields of the document:

- Document transaction (type) – Other expense;

- Amount – identified discrepancy;

- Debit account – 94 “Shortages and losses from damage to valuables”;

- We post the document (button Conduct) and check the movement of the document:

- Bank and Cashier- Cash register - Cash documents- button Cash book.

The completed operation is recorded in this report:

Let's attribute the shortage to the culprit - the cashier (posting Dt 73.02 - Kt 94) using the document Operation. Chapter Operations – Accounting - Manual Transactions- button Create:

However, if a situation arises where the cashier’s guilt is not established, for example, the cash register was hacked and the funds were stolen, then the shortage is attributed to other expenses.

If excess funds are found in the cash register

When taking inventory of the cash register, surpluses may be discovered, that is, the accounting amount of money in the cash register turns out to be less than the actual amount.

Let's say on 04/01/2016. There was a surplus of cash in the cash register in the amount of 158.12 rubles. In this case, funds are reflected in the accounting document Cash receipts, posting Dt 50.01 – Kt 91.01.

- Create a Cash Receipt document. Chapter Bank and Cash desk – Cash desk – Cash documents- button Admission.

- Fill in the fields of the document:

- Document transaction (type) – Other receipt;

- Amount – identified discrepancy;

- Credit account – 91.01 “Other income”.

- Fill out the basis of the document and the application:

- We post the document (button Conduct) and check the movement of the document:

- We will create a cash book for 04/01/2016. Chapter Bank and Cashier- Cash register - Cash documents- button Cash book.

The completed operation is recorded in this report.

The procedure for conducting an inventory of funds and settlements is determined in accordance with the procedure for conducting cash transactions in the national economy

By the beginning of the inventory, all expenditure and receipt documents must be submitted to the accounting department of the enterprise. Before starting the inventory, the following is checked:

- 1. the cashier has rules for conducting cash transactions;

- 2. is the premises suitable for storing cash and securities;

- 3. whether an agreement on full financial liability has been concluded with the person performing the functions of a cashier.

When taking inventory at the cash desk, a complete recalculation of the funds in the cash register is carried out. When calculating the actual presence of banknotes and other valuables in the cash register, cash, securities and monetary documents (postage stamps, state duty stamps, bill stamps, vouchers to holiday homes and sanatoriums, air tickets, etc.) are taken into account.

Checking the actual availability of securities forms and other forms of strict reporting documents is carried out by type of form (for example, by shares: registered and bearer, preferred and ordinary), with

taking into account the starting and ending numbers of certain forms, as well as for each storage location and financially responsible persons.

Inventory of funds in transit is carried out by reconciling the amounts listed in the accounting accounts with the data of receipts from a bank institution, post office, copies of accompanying statements for the delivery of proceeds to bank collectors, etc.

Inventory of funds held in banks in settlement (current), foreign currency and special accounts is carried out by reconciling the balances of the amounts listed in the corresponding accounts, according to the accounting department of the enterprise (institution), with data from bank statements.

An inventory of settlements with banks and other credit institutions for loans, with the budget, buyers, suppliers, accountable persons, employees, depositors, other debtors and creditors consists of checking the validity of the amounts listed in the accounting accounts.

The account “Settlements with suppliers and contractors” for goods paid for but in transit, and settlements with suppliers and contractors for uninvoiced suppliers should be checked. It is verified against documents in accordance with the corresponding accounts.

For debts owed to employees of enterprises (institutions), unpaid amounts of wages are identified that are subject to transfer to depositor accounts, as well as the amounts and reasons for overpayments to employees.

When inventorying accountable amounts, reports of accountable persons on advances issued are checked, taking into account their intended use, as well as the amount of advances issued for each accountable person (dates of issue, intended purpose).

The inventory commission, through a documentary check, must also establish:

- 1. correctness of settlements with financial banks. Tax authorities, off-budget funds, other enterprises (institutions), as well as with structural divisions of enterprises (institutions) allocated to separate balance sheets;

- 2. the correctness and validity of the amount of debt recorded in the accounting records for shortages and thefts;

- 3. the correctness and validity of the amounts of receivables, payables and depositors, including the amounts of receivables and payables for which the statute of limitations has expired.

Thus, the main feature of the inventory of fixed assets is that their availability is checked by inspecting all objects and the availability of documents confirming the location of these objects in the ownership of the enterprise. For some objects, the amount of increase or decrease in the book value of this object is determined. The presence of inventory items is checked by mandatory recalculation, reweighing or mixing. There are also features of inventory management in cases where, during the inventory, inventory items were received, released, shipped, not paid on time, are in the warehouses of other organizations, transferred for processing to another enterprise, are in operation, issued for individual use to employees or have fallen into disrepair and are not written off. The availability of funds, securities and monetary documents, forms of securities and other forms of strict reporting documents, funds in transit, funds in current, foreign currency and special accounts are checked when conducting an inventory of funds, monetary documents and strict reporting forms. Members of the inventory commission must remember that the mistakes they make will largely affect the result of the inventory.

According to existing standards of domestic legislation, each commercial structure must regularly organize an inventory check own cash register, assets, inventories or strict reporting forms. Such obligations are imposed on all enterprises, regardless of their type of activity and form of ownership.

The only condition is the company has the status of a legal entity. In the process of conducting such an audit, employees who are members of the inventory commission are engaged in the recalculation of strict reporting forms and other types of property, and also carry out a complete inventory of financial reserves.

The procedure for conducting an inventory of cash at the cash desk is completely covered by regulation of the existing procedure for conducting cash transactions. This process is initiated on the basis of an issued order from the head of the enterprise.

The procedure for conducting an inventory of cash at the cash desk is completely covered by regulation of the existing procedure for conducting cash transactions. This process is initiated on the basis of an issued order from the head of the enterprise.

In addition, a special resolution or order may serve as the basis for starting an inventory.

Responsible for carrying out this procedure members of a specially created inventory commission. This commission may include both representatives of the company’s management and employees of any other division of the organization, regardless of their type of activity and qualification level.

The existing scheme for conducting a cash inventory assumes that immediately before starting this process, members of the commission will have to receive all the latest incoming and outgoing documentation on cash flows. Cashiers, who are financially responsible persons, must give their confirmation in writing that the documents were transferred to the inventory commission or the accounting department, and all cash from the cash register was successfully capitalized, and those that were withdrawn were written off as expenses.

At the next stage of the inventory check, cash count, which was in the cash register. The amount received by the commission members as a result of the calculation is compared with the accounting figures that were recorded in the previously submitted documentation. In addition, it is mandatory to check the information that is recorded in the memory of cash registers owned by the company.

The procedure for conducting an inventory check of cash at the cash desk involves compliance with certain methodological recommendations:

- All members of the commission must be on it. Otherwise, the final results of such a check will not be recognized as legitimate.

- Each inventory and each inventory act must be drawn up in several copies.

- The procedure for counting money at the cash register requires the presence of the financially responsible person, who is the cashier.

- All documents must be signed by each member of the commission, as well as by the person bearing financial responsibility.

- Any blots in the inventory check reports are unacceptable. All errors are corrected by crossing out incorrect data. Correct entries must be placed on top of those crossed out. All corrections must be endorsed by the commission members.

Based on this, the final inventory act on cash from the cash register must contain data on accounting and actual cash balances, a list of commission members, as well as signature of each of them. Next, the results of such verification are transferred to the immediate manager of the company.

The interpretation of the final audit data must have next view:

- If the data matches, it is concluded that the accounting process within the organization is carried out correctly, and the cashiers work without errors.

- If cash or excess cash is identified, then a procedure will be carried out to revise the accounting rules, assess the professional level of the cashier, and also study his reliability.

Checking funds in company bank accounts

The process of preparing annual financial statements should be accompanied by inventory of monetary resources on the current accounts of a commercial organization. This is due to the fact that most organizations, in addition to cash, use special non-cash forms of payment for mutual settlements with their own counterparties.

The process of preparing annual financial statements should be accompanied by inventory of monetary resources on the current accounts of a commercial organization. This is due to the fact that most organizations, in addition to cash, use special non-cash forms of payment for mutual settlements with their own counterparties.

These types of financial transactions are carried out by banks using bank accounts. Each commercial structure has the right to open its own bank account for settlements with its partners in both Russian and foreign currency.

Current bank accounts are used for the purpose of storing and moving money supply. A company may have several current accounts at once, which can be opened in various banking institutions. In addition, a company can open its own foreign currency current account both abroad and within the Russian Federation.

Immediately before an inventory check of funds in the company’s current accounts is carried out, it is necessary to establish exactly which accounts and in which banks were opened by the commercial structure. For this purpose, detailed study existing agreements on the provision of banking services.

At the same time, it is necessary to establish the real value and feasibility of using certain current accounts. Depending on the location of the buyer and supplier, the need to use one or another type of current account is determined. Based on this, all current accounts are usually divided into local And out-of-towners.

The inventory process takes into account the need to compare the terms of the agreement regarding opening a current account with synthetic accounting information, which can confirm the size of financial balances in the company’s bank accounts. used to summarize all movements and the availability of funds in accounts. In this account, all funds can be assessed exclusively in terms of rubles.

The process of inventorying funds in a company's bank accounts is carried out as part of reconciling the balances of debit accounts with information from bank statements. The company must receive confirmation from the bank about the amount of funds in the accounts. At the same time, the size of residual funds within the framework of analytical and synthetic accounting is compared with the balance of bank accounts on the balance sheet.

An inventory check involves checking the identity of the turnover in the debit and credit of the information accounts contained in bank statements.

Members of the inventory commission are required to reconcile bank statements with the provided supporting documentation, which should establish the correct amount of funds indicated in the statements.

The completeness of bank statements is determined based on their numbering for each individual page, as well as on the transfer of the balance of funds in the accounts.

Availability of strict reporting forms

Procedure for checking the actual number of available strict reporting forms assumes:

Procedure for checking the actual number of available strict reporting forms assumes:

- Compliance with the standards for completing such forms.

- The size of the real value of the accounted BSO.

- Comparison of the actual number of BSO with accounting data.

- Efficiency and completeness of information about the amount of income received when using strict reporting forms.

The inventory procedure for strict reporting forms takes place simultaneously with checking the amount of cash in the cash register.

The audit of existing SSBs in the organization takes into account reconciliation by individual issuers with the name entered in the inventory act. It is also necessary to compare the details of each strict reporting form with information from the registers and books that are stored in the company’s accounting department.

Results

For most managers of commercial structures, inventory is the most powerful tool, allowing to increase the overall performance indicators of company management. It is worth considering that for the correct conduct of such a process, a high level of competence of the members of the inventory commission in the regulatory and legislative sphere is required.

How this process occurs in 1C Accounting can be found in this presentation.